A Newsletter for Extension Staff

Livestock Marketing Information Center

State Extension Services in Cooperation with the USDA

Market Indicators . . . December 17, 2021

Trends…CPI GROWTH THE FASTEST IN DECADES

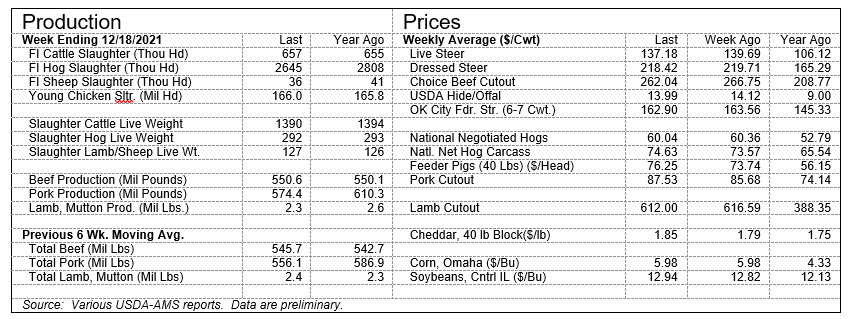

The latest Consumer Price Index (CPI) data was released for the month of November which showed a 6.8% increase from last year to 277.9 for All Items. November marks the fastest rate of growth for the CPI since June 1982 which rose 7.1%. Although the rate of growth is the fastest in nearly four decades, it is still below levels seen during the late 1970’s and early 1980’s which were well above 6% and several months recorded double digit growth.

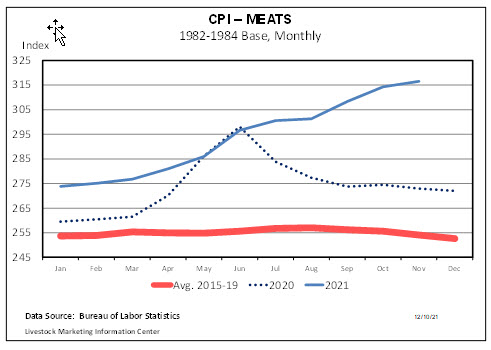

The Food CPI grew by 6.1% to 285.5 in November which is the fastest rate of growth since October 2008 (6.3%). Much of the growth in Food CPI is likely driven by surging meat and poultry prices as indicated by the Meat and Poultry CPI. The Meat CPI continued its double-digit growth with November 16.0% above last year to 316.5. During the pandemic the Meat CPI grew 16.7% which is still below growth rates of the late 1970’s which reached into the 20% range for several months. The Poultry CPI grew 8.4% to 267.5 which is just below increase of 8.7% in June 2020 during the pandemic.

November choice retail beef prices were $7.85 per pound which eased slightly (5 cents) from the prior months record high of $7.90. Prices for ground beef, roast, round, and sirloin all remained elevated at in November at $4.72, $7.27, $7.40, and $11.51 per pound, respectively. Retail pork prices continued to climb in November reaching $4.82 per pound which marks the eighth consecutive month that retail pork prices have set a new record. Boneless hams reached a record of $4.94 per pound while bacon and chops remain elevated at $7.27 and $4.43, respectively. The broiler composite retail price hit a record of $2.21 per pound, the fifth consecutive month for a record price.

The November CPI for All Items, Food, Meat, and Poultry were at some of the highest growth rates in decades. November retail pork and poultry prices reached record levels again while retail beef prices were the third highest on record. As the holiday season is right around the corner and 2021 draws to a close, consumers are likely starting to feel the effects of inflation and record high meat prices. Moving into 2022, inflation will continue to be in the forefront and likely pose as a headwind for meat demand.

RECORD PRICES FOR SHEEP AND LAMB

The sheep and lamb industry is shaping up to have a record setting year for prices. Feeder lamb prices (3-Market Average; CO, TX & SD) have tracked above 2020 levels every week expect for one in March which was $230 per cwt, the lowest price for the year. In February, a record price was set for feeder lambs at $342 per cwt and prices are likely to average about $260 for the year. The average feeder lamb price was $192 per cwt in 2020. Slaughter lamb prices rose quickly to start the year and set a record price in early-August at $268 per cwt. Since the peak, prices have moved slightly lower but were still above $220 per cwt.

Wholesale lamb values have been phenomenal this year with record levels having been set within the last five months and prices continue to remain elevated. The National Lamb Cutout value (Gross Carcass FOB, 5 Day Rolling Avg) rose 66% ($255) since the start of the year to a record value of $639 per cwt in early-August and since that point has average $624. In August, the shoulder price (Square Cut, 5 Day Rolling Average) jumped to a record price of $609, nearly double the prior year. Leg prices reached a record of $604 per cwt in early October and have averaged about $600 since the peak. The loin and rack both set record price levels in November at $1,074 and $1,461 per cwt, respectively.

Sheep and lamb slaughter is likely to be above 2020 as year-to-date slaughter is tracking about 2% higher. Average dressed weights through mid-December are about 2.4% (1.6 lbs.) lower than a year ago which has more than offset the higher slaughter numbers resulting a lamb production down marginally (-0.1%). Although lamb production levels will likely be near last year, the record setting lamb prices have been driven by exceptional domestic demand. Per capita lamb consumption for 2021 is expected to be over 1.3 pounds per person for the year which would be the highest level since the early 1990’s. A recent survey of lamb consumers by the American Lamb Board concluded that improved lamb consumption has been linked to the availability of more lamb cuts in grocery stores year-round and not just around holidays.

DAIRY PRODUCT PRICES ACCELERATE

With the exception of cheese, butter, dry whey and nonfat dry milk prices have all climbed higher and higher over the last several weeks. Butter prices in the last week hit a two year high, breaking above $2 per pound for the first time since the week of December 7th, 2019. Dry whey prices are above $0.60 per pound after seeing modest declines in late summer following the peak of just over $0.65 per pound this summer. Nonfat dry milk reached $1.50 per pound for the last two weeks. Those prices have largely been above 2020 levels since the second quarter of the year. These are the highest nonfat dry milk prices posted since 2014.

The most recent dairy product production report released by USDA NASS is for October. Butter production was listed below a year ago, a trend that has been true most of the year. Year to date (Jan-Oct) total production figures indicate butter production is off 2020’s pace by 2.3%. Dry whey production increased 4% from a year ago in October, but the two previous months were lower, with September dropping 9% from 2020 levels. Dry whey through 10 months of the year is down 4% compared to the same timeframe last year. Nonfat dry milk has posted lower production figures in the last 4 months. October recorded a figure 12% below 2020. Year to date, however, is a different story, up nearly 4% from 2020. Total cheese production is up 3% from Jan-October, and the most recent month was up less than 1%. Cheddar cheese, which feeds into milk price calculations is up more than 3% for the first 10 months of the year, but October was lower than a year ago by 1.5%.

Stock levels are also contributing to higher prices. Butter stocks in October were down 6% from last year, as are nonfat dry stocks. Cheese stocks are higher than last year. Milk cow inventory has fallen nearly 100 thousand head since the peak earlier this year and is close to year ago levels. Total U.S. milk production is also similar to a year ago. Dairy cow slaughter year to date is 2.3% higher, but in recent weeks has jumped significantly higher. Since mid-June dairy cow slaughter has averaged 6.4% higher on a weekly basis. In the near term it is unlikely dairy farmers will produce enough milk to alleviate higher product prices. Not only are there supply side constraints, but international demand has been stronger too. Nearly all the major dairy export categories (HTS 0401-0406) are higher than a year ago by double digits in January-October data.