The Pasture, Range, and Forage Insurance (PRF) deadline to sign up for coverage for 2023 is on December 1. Often referred to as “rainfall insurance,” this product can be a useful risk management tool for landowners and livestock producers. The product provides insurance coverage for grazing pastures, rangeland, and perennial forage acres.

Photo by Jen Wewers on Unsplash

Essentially, PRF allows a landowner to insure a certain percentage of historic rainfall in the area where they own property. If the actual rainfall in the area falls below the insured percentage, the landowner receives an indemnity payment. PRF may be purchased from any crop insurance agent. A good agent can help walk through the details of the insurance product and assist with the decisions that a landowner must make in the sign up process.

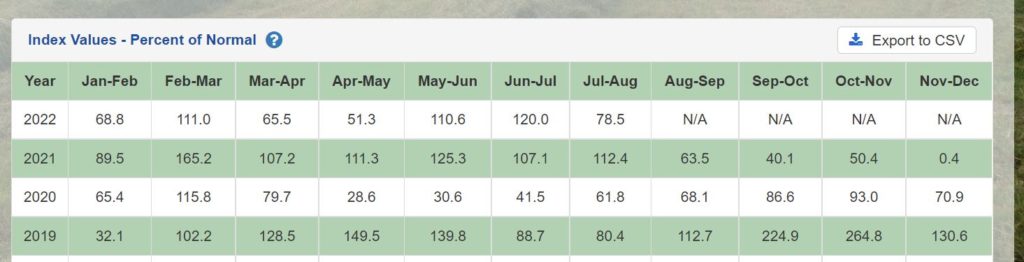

The first step in analyzing whether to purchase PRF insurance is to determine the “grid” where property is located. The historic rainfall used to establish PRF insurance coverage is tied to specific grids, with each one being approximately 17-miles by 17-miles. Do note that land can be located in multiple grids depending on how the grid lines fall. Once a landowner determines the grid(s) he or she can use for PRF coverage, the USDA PRF Support Tool can be used to see the various choices available. The landowner can click on “Historical Indexes” and see the rainfall percent of normal in that grid for the last 74 years.

For example, I own land in Grid 18716. As you can see below, in January-February of 2021, my grid received 68.8% of normal rainfall. Because I insured 85% of normal rainfall in that period, I received an indemnity payment. Looking at the May-June period, my grid received 110.6% of normal rainfall and no indemnity payment was triggered under my PRF policy.

The next step for landowners is to analyze options including which periods they will insure, the level of rainfall they will insure, the productivity factor, and the percentage of coverage in each period. Again, a good crop insurance agent can help walk through each of these decisions. The USDA PRF Support Tool will also allow landowners to put in information and compare the historic results with different combinations of coverage levels, productivity value, and periods insured.

For example, looking again at my grid, when the rainfall was 68.8% in January-February, with my given coverage levels, I received an indemnity of $212. The amount of payment here depends on the percentage of rainfall insured, productivity value selected, and percent of value chosen for that period. However, had I decided to insure February-March instead of January-February, I would have received no indemnity payment because in that interval, rainfall was 111% of normal.

For more information on PRF Insurance:

- I’ve got a great podcast episode with Dr. Jason Johnson talking about the program and walking through each of the decisions a landowner has to make.

- Dr. Justin Benavidez wrote a great article for Progressive Cattle discussion PRF insurance.

- Dr. Justin Benavidez has a blog post walking through the details of the PRF decisions.